Essay

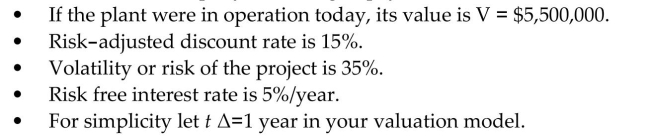

A Korean auto-part supplier is evaluating an investment project to build a manufacturing plant close to Kia

Automobile Assembly Plant near West Point, Georgia. The supplier can obtain a 1-year option to buy the

required parcel of land near West Point area and if the land is purchased the price would be $1,500,000. The

land option, if purchased, would expire 1-year from now. The supplier has two years to make a decision on

whether to build the plant and start operations, once the land was purchased. The required capital investment

would be $5,000,000. They estimate that the land, if purchased, could be sold for 110% of its purchase price

anytime over next two years.

What would the company be willing to pay for the combined value of the land option?

Correct Answer:

Verified

Correct Answer:

Verified