Essay

Having learned in macroeconomics that consumption depends on disposable income, you

want to determine whether or not disposable income helps predict future consumption.

You collect data for the sample period 1962:I to 1995:IV and plot the two variables.

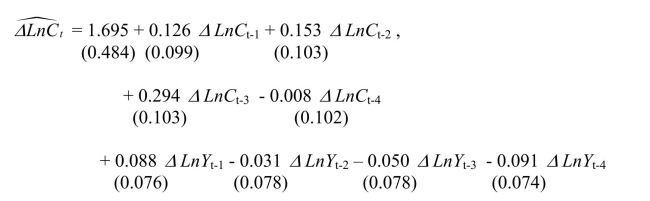

(a)To determine whether or not past values of personal disposable income growth rates help

to predict consumption growth rates, you estimate the following relationship.  The Granger causality test for the exclusion on all four lags of the GDP growth rate is

The Granger causality test for the exclusion on all four lags of the GDP growth rate is

0.98.Find the critical value for the 1%, the 5%, and the 10% level from the relevant table

and make a decision on whether or not these additional variables Granger cause the

change in the growth rate of consumption.

Correct Answer:

Verified

Answer  Ma...

Ma...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Autoregressive distributed lag models include<br>A)current and lagged

Q7: Stationarity means that the<br>A)error terms are not

Q9: In order to make reliable forecasts with

Q15: One reason for computing the logarithms (ln),

Q23: If a "break" occurs in the population

Q26: The Times Series Regression with Multiple

Q27: You want to determine whether or not

Q28: One of the sources of error

Q33: <span class="ql-formula" data-value="\text { Consider the AR(1)

Q34: The root mean squared forecast error