Multiple Choice

Apply the expected value approach to decision making.

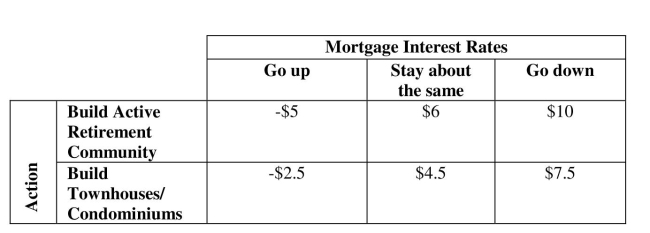

-A land owner is considering a community development project in the southeastern U.S.

He is faced with two alternatives: (1) build detached homes in a planned retirement

Community or (2) build a smaller townhouse / condominium complex. Mortgage interest

Rates will affect his outcomes and the payoff (in $ millions) table is shown below. If the

Probabilities for future mortgage interest rates going up, staying about the same, and

Going down are .35, .50 and .15, respectively, the best decision according to the expected

Value approach is to

A) build the active retirement community if interest rates go down.

B) build the active retirement community.

C) build townhouses / condominiums if interest rates go down.

D) build townhouses / condominiums.

E) build either the active retirement community or townhouses / condominiums.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Use a payoff table or decision

Q6: Find the expected value of an action.<br>-A

Q7: Use a payoff table or decision tree.<br>-A

Q8: Apply the expected value approach to

Q9: Find the expected value of perfect

Q12: Find expected values, standard deviations and return

Q13: Find the expected value of perfect information.<br>-A

Q14: Consider the following to answer the question(s)

Q14: Find the expected value of an

Q15: Revise probabilities based on sample information.<br>-A mid-size