Short Answer

SCENARIO 13-7

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500,then it is possible to reduce the variability of the portfolio's return.In other words,one can create a portfolio with positive returns but less exposure to risk.

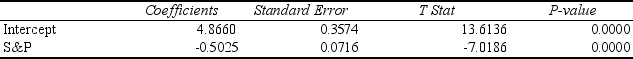

A sample of 26 years of S&P 500 index and a portfolio consisting of stocks of private prisons,which are believed to be negatively related to the S&P 500 index,is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y)on the returns of S&P 500 index

(X)to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

-Referring to Scenario 13-7,to test whether the prison stocks portfolio is negatively related to the S&P 500 index,the p-value of the associated test statistic is

Correct Answer:

Verified

Correct Answer:

Verified

Q127: SCENARIO 13-13<br>In this era of tough economic

Q128: SCENARIO 13-4<br>The managers of a brokerage firm

Q129: SCENARIO 13-10<br>The management of a chain electronic

Q130: SCENARIO 13-5<br>The managing partner of an advertising

Q131: SCENARIO 13-12<br>The manager of the purchasing department

Q133: SCENARIO 13-12<br>The manager of the purchasing department

Q134: SCENARIO 13-1<br>A large national bank charges

Q135: SCENARIO 13-12<br>The manager of the purchasing department

Q136: What do we mean when we say

Q137: SCENARIO 13-13<br>In this era of tough economic