Multiple Choice

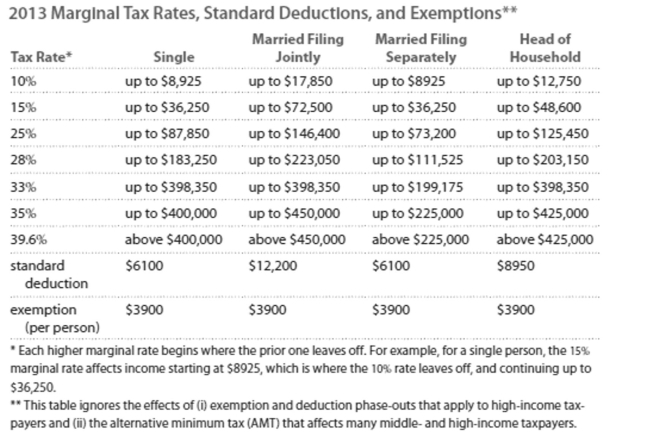

Solve the problem. Refer to the table if necessary.

-You are single and have a taxable income of $56,767. You make monthly contributions of $455 to a tax-deferred savings plan. Calculate the effect on annual take-home pay of the tax-deferred

Contribution.

A) Take-home pay will be $1365 more per year with tax-deferred plan

B) Take-home pay will be $1820 less per year with tax-deferred plan

C) Take-home pay will be $1820 more per year with tax-deferred plan

D) Take-home pay will be $1365 less per year with tax-deferred plan

Correct Answer:

Verified

Correct Answer:

Verified

Q59: Use the compound interest formula for compounding

Q60: Solve the problem.<br>-<img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3069/.jpg" alt="Solve the problem.

Q61: Solve the problem. Refer to the

Q62: Provide an appropriate response.<br>-A(n)_ deduction is the

Q63: Solve the equation for the unknown.<br>-

Q65: Solve the equation for the unknown.<br>-

Q66: Write the word or phrase that best

Q67: Provide an appropriate response.<br>-A _ represents money

Q68: Calculate the amount of interest you'll have

Q69: Calculate the balance under the given assumptions.<br>-Find