Multiple Choice

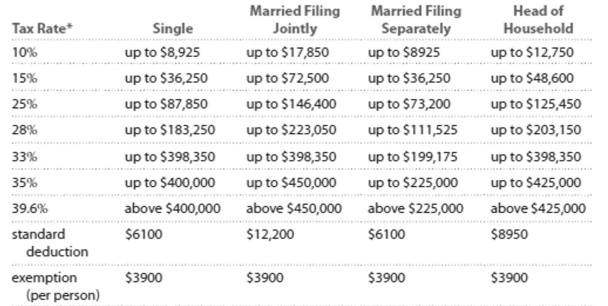

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductlons, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle-and high-income taxpayers.

-Bill earned wages of $47,227, received $1837 in interest from a savings account, and contributed $ 3010 to a tax deferred retirement plan. He was entitled to a personal exemption of $3900 and had

Deductions totaling $7719. Find his adjusted gross income.

A) $52,074

B) $34,435

C) $46,054

D) $59,793

Correct Answer:

Verified

Correct Answer:

Verified

Q105: Decide whether the statement makes sense. Explain

Q106: Solve the problem. Refer to the table

Q107: Provide an appropriate response.<br>-Which of the following

Q108: Answer the question.<br>-You currently drive 360 miles

Q109: For the loan described, calculate the monthly

Q111: Decide whether the statement makes sense. Explain

Q112: Use the compound interest formula to determine

Q113: Decide whether the statement makes sense. Explain

Q114: Evaluate or simplify the following the

Q115: Find the annual percentage yield (APY).<br>-A