Multiple Choice

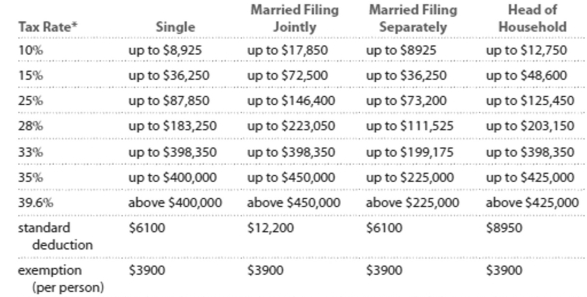

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductlons, and Exemptlons**

"Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" "This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle-and high-income taxpayers.

-Kelly and Kurt are married filing jointly with a taxable income of $92,745. Calculate the amount of tax owed.

A) $15,044

B) $23,186

C) $12,311

D) $15,936

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Complete the sentence: On an annual basis

Q7: The expenses and income of an

Q8: Provide an appropriate response.<br>-For any loan, the

Q9: Provide an appropriate response.<br>-There is high risk

Q10: Solve.<br>-Tim is in the 35% marginal tax

Q12: Use the compound interest formula for compounding

Q13: Solve the problem.<br>-You want to have a

Q14: Complete the sentence: On an annual basis

Q15: Provide an appropriate response.<br>-Which of the following

Q16: Solve the problem.<br>-The average cost of a