Multiple Choice

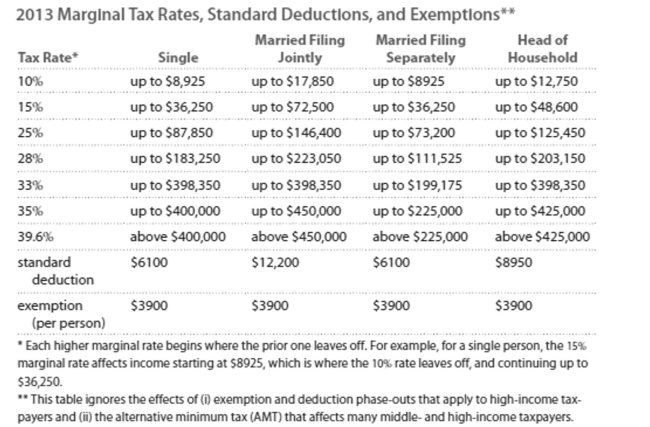

Solve the problem. Refer to the table if necessary.

-Carmen and James are married and filed jointly. Their combined wages were $91,109. They earned a net of $1887 from a rental property they own, and they received $1595 in interest. They

Claimed four exemptions for themselves and two children. They contributed $3701 to their

Tax-deferred retirement plans, and their itemized deductions total $9765. Find their adjusted gross

Income.

A) $81,125

B) $90,890

C) $87,700

D) $108,057

Correct Answer:

Verified

Correct Answer:

Verified

Q185: Provide an appropriate response.<br>- If you

Q186: Evaluate or simplify the following the

Q187: Solve the problem.<br>-You want to have a

Q188: Solve the problem.<br>-The table below shows

Q189: Use the compound interest formula for continuous

Q191: Complete the sentence: On an annual basis

Q192: Use the given stock table to

Q193: Provide an appropriate response.<br>-The lump sum deposit

Q194: Solve the problem. Refer to the

Q195: Provide an appropriate response.<br>-Which of the following