Multiple Choice

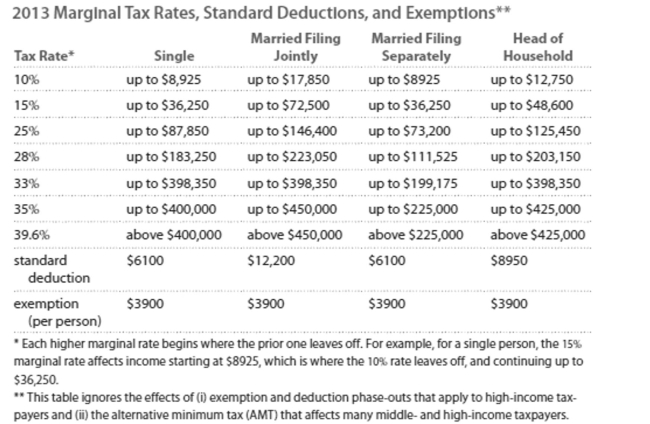

Solve the problem. Refer to the table if necessary.

-Matt is single and earned wages of $32,338. He received $421 in interest from a savings account. He contributed $588 to a tax-deferred retirement plan. He had $579 in itemized deductions from

Charitable contributions. Calculate his taxable income.

A) $25,492

B) $27,692

C) $22,171

D) $37,247

Correct Answer:

Verified

Correct Answer:

Verified

Q72: Solve the equation for the unknown.<br>-

Q73: Solve the equation for the unknown.<br>-

Q74: You need a loan of $100,000

Q75: Solve.<br>-Calculate the monthly payment for a student

Q76: Write the word or phrase that

Q78: Solve the problem.<br>-Anna deposits $2500 in a

Q79: Provide an appropriate response.<br>-The _ in financial

Q80: Write the word or phrase that best

Q81: You need a loan of $100,000

Q82: Solve the problem.<br>-Kerry invests $362 in