Multiple Choice

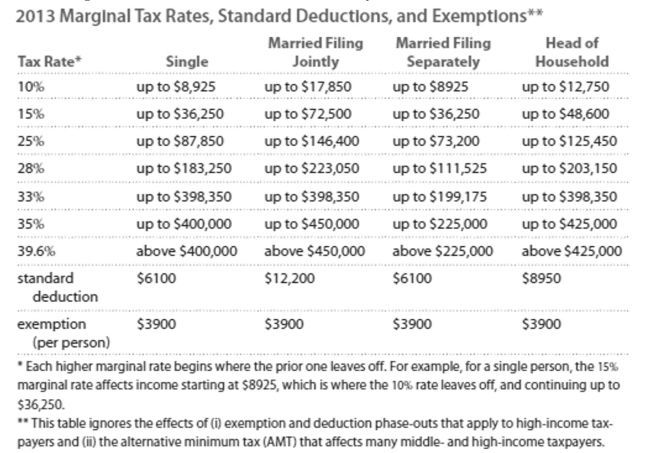

Solve the problem. Refer to the table if necessary.

-Jenny earned wages of $99,016, received $5325 in interest from a savings account, and contributed $ 5935 to a tax deferred retirement plan. She was entitled to a personal exemption of $3900 and had

Deductions totaling $8971. Find her taxable income.

A) $85,535

B) $93,335

C) $98,406

D) $110,276

Correct Answer:

Verified

Correct Answer:

Verified

Q47: Solve the equation for the unknown

Q48: Find the annual percentage yield (APY).<br>-A bank

Q49: Solve the problem.<br>-Suppose your after-tax income is

Q50: Provide an appropriate response.<br>-A mortgage lender will

Q51: Calculate the balance under the given assumptions.<br>-Find

Q53: Solve the problem.<br>-Calculate the current yield for

Q54: Solve the problem.<br>-$5832 is deposited into a

Q55: Solve.<br>-Determine the total payment over the term

Q56: Solve the equation for the unknown

Q57: Provide an appropriate response.<br>-What is the