Multiple Choice

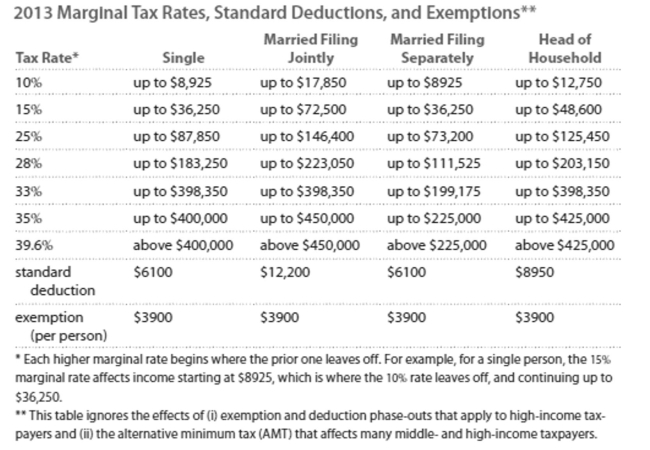

Solve the problem. Refer to the table if necessary.

-Jeff earned wages of $48,267, received $1837 in interest from a savings account, and contributed $ 3210 to a tax deferred retirement plan. He was entitled to a personal exemption of $3900 and had

Deductions totaling $7314. Find his taxable income.

A) $60,628

B) $43,480

C) $53,314

D) $35,680

Correct Answer:

Verified

Correct Answer:

Verified

Q81: You need a loan of $100,000

Q82: Solve the problem.<br>-Kerry invests $362 in

Q83: Solve the problem.<br>-Calculate the annual interest for

Q84: Decide whether the statement makes sense. Explain

Q85: Provide an appropriate response.<br>-The relative change in

Q87: Determine whether the spending pattern described is

Q88: Write the word or phrase that best

Q89: Solve the problem.<br>-In a recent year, the

Q90: Answer the question.<br>-You have a choice between

Q91: Solve the equation for the unknown