Multiple Choice

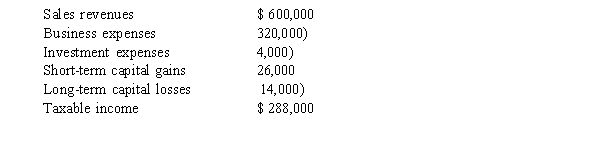

Teresa, Terri, and Tricia operate Sassy Solutions, an exclusive boutique. Based on advice from Teresa's sister, a CPA, the three form a partnership. Teresa owns 50% and Terri and Tricia each own 25%. For the year, Sassy Solutions reports the following:  For tax purposes, what amount will Sassy Solutions report to Teresa as her ordinary income from the partnership?

For tax purposes, what amount will Sassy Solutions report to Teresa as her ordinary income from the partnership?

A) $144,000

B) $146,000

C) $148,000

D) $138,000

E) $140,000

Correct Answer:

Verified

Correct Answer:

Verified

Q5: List the criteria necessary for an expenditure

Q26: Sarah extensively buys and sells securities .

Q62: Which of the following factors are used

Q84: Using the tests for deductibility discussed in

Q85: William, a single taxpayer, has $3,500 state

Q91: In which of the following independent situations

Q106: Which of the following is a currently

Q117: Karen owns a vacation home in Door

Q124: Henry owns a hardware store in Indianapolis.

Q141: In order to take a business deduction,