Short Answer

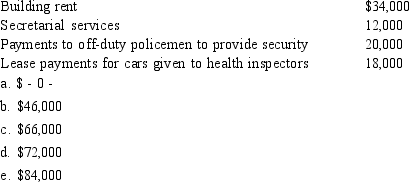

Chelsea operates an illegal gambling enterprise out of her restaurant. Considering only the following expenses, what amount can Samantha deduct?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q11: Which of the following factors are used

Q50: An exception to the economic performance test

Q57: Charlotte traveled to Annapolis to attend a

Q62: Which of the following factors are used

Q72: Which of the following is an example

Q74: Mario paints landscape portraits, and he treats

Q86: For a taxpayer to be engaged in

Q115: Generally income tax accounting methods are designed

Q124: Henry owns a hardware store in Indianapolis.

Q162: Kim owns and operates a restaurant on