Multiple Choice

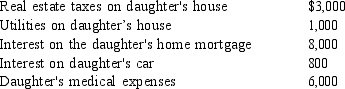

Jennifer pays the following expenses for her dependent 30-year old daughter while the daughter was ill during the current year:  How much of the above expenditures may Jennifer use in computing her itemized deductions?

How much of the above expenditures may Jennifer use in computing her itemized deductions?

A) $ - 0 -

B) $ 6,000

C) $ 9,000

D) $14,800

E) $17,000

Correct Answer:

Verified

Correct Answer:

Verified

Q31: Oscar drives a taxi on weekends. In

Q34: Which of the following can be deducted

Q36: The legislative grace concept dictates that deductible

Q42: Devery, Inc. sells high tech machine parts

Q52: Kelly buys a new Lexus for $48,750

Q74: An ordinary expense<br>I.is an expense commonly incurred

Q96: Indicate which of the following statements is/are

Q103: Which of the following payments are currently

Q131: Christy purchases $1,000-worth of supplies from a

Q156: Electronic City sells various electronic products. With