Multiple Choice

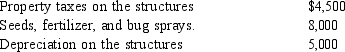

Virginia, a practicing CPA, receives $11,000 from the sale of rare orchids that she grows. Her expenses of operating this hobby activity follow:  How much of the expenses that Virginia incurs can be deducted as hobby expenses?

How much of the expenses that Virginia incurs can be deducted as hobby expenses?

A) $ - 0 -

B) $ 4,500

C) $11,000

D) $12,500

E) $17,500

Correct Answer:

Verified

Correct Answer:

Verified

Q25: Diana bought 1,500 shares of Dalton Protection,

Q29: Business expenses include<br>I.expenditures that have a business

Q63: Jim operates a business out of his

Q66: Which of the following expenses is/are deductible?<br>I.Transportation

Q67: Income tax accounting methods and financial accounting

Q93: To be deductible, the dominant motive for

Q114: An individual is indifferent whether an expense

Q116: During the current year, Paul came down

Q136: Which of the following is/are currently deductible

Q143: Angel owns a gourmet Mexican restaurant. His