Multiple Choice

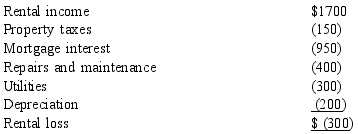

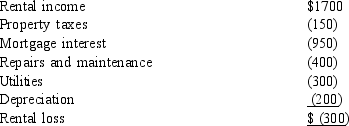

Tom and RoseMary own a cabin near Stowe, Vermont. During the current year the cabin is rented for 31 days for $1,800. Tom and RoseMary used the cabin a total of 12 days during the year. After making the appropriate allocation of expenses between personal and rental use, the following rental loss was determined:

How should Tom and RoseMary report the rental income and expenses for the current year?

How should Tom and RoseMary report the rental income and expenses for the current year?

A) Include the $1,700 in gross income, but no deductions are allowed.

B) Report the $300 loss for AGI.

C) Only expenses up to the amount of $1,700 rental income may be deducted in the current year.

D) Report the interest $950) and taxes $150) as itemized deductions and the other expenses for AGI.

E) No reporting for the rental activity should be reported.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Portia, a CPA, operates a financial and

Q25: Amy borrowed $25,000 for her business from

Q39: Which of the following expenditures are not

Q59: A taxpayer can take a deduction for

Q79: Which of the following expenditures are not

Q80: Evelyn can avoid the 2 percent limitation

Q90: Which of the following production of income

Q121: Generally income tax accounting methods are designed

Q164: Several factors are used to determine whether

Q166: If a taxpayer owes interest, economic performance