Multiple Choice

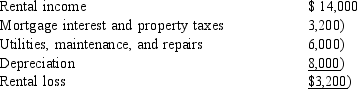

Landis is a single taxpayer with an adjusted gross income of $280,000. In addition to his personal residence, Landis owns a vacation home in Beaver Creek, Colorado. He uses the vacation home for 21 days during the current year and rents it out to unrelated parties for 63 days. After making the appropriate allocation between rental and personal use, the following rental loss is determined:  What is the correct reporting of the rental income and expenses? I. Because the rental shows a loss, Landis reports no income and deducts the mortgage interest and property taxes as an itemized deduction. II. Landis must report the $14,000 in rental income but he can deduct only $14,000 of the expenses. III. Landis's depreciation deduction is limited to $4,800. IV. Because the vacation home is a qualified second residence, Landis can deduct the $1,600 loss for adjusted gross income.

What is the correct reporting of the rental income and expenses? I. Because the rental shows a loss, Landis reports no income and deducts the mortgage interest and property taxes as an itemized deduction. II. Landis must report the $14,000 in rental income but he can deduct only $14,000 of the expenses. III. Landis's depreciation deduction is limited to $4,800. IV. Because the vacation home is a qualified second residence, Landis can deduct the $1,600 loss for adjusted gross income.

A) Only statement II is correct.

B) Only statement IV is correct.

C) Only statement I is correct.

D) Statements II and III are correct.

E) Statements II and IV are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Claire and Harry own a house on

Q17: Discuss whether the following expenditures meet the

Q25: Amy borrowed $25,000 for her business from

Q37: Which of the following factors absolutely must

Q65: Michael operates an illegal cock fighting business.

Q68: For its financial accounting records Addison Company

Q90: Which of the following production of income

Q95: Pamela owns the building where her plumbing

Q114: The all-events test requires that<br>I.All events have

Q152: A necessary expense is one that is