Short Answer

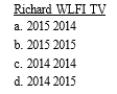

Richard, a cash basis taxpayer, is an 80% owner and president of WLFI TV. WLFI TV is an S corporation and uses the accrual method of accounting. On December 1, 2014, WLFI TV accrues a bonus of $50,000 to Richard. The bonus is payable on January 31, 2015. In what year does Richard report the income and WLFI TV take the deduction?

Correct Answer:

Verified

Correct Answer:

Verified

Q20: An exception to the economic performance test

Q49: Shaheen owns 2 rental properties. She hires

Q50: Which of the following individuals is involved

Q53: Which of the following is/are trade or

Q56: Which of the following people is currently

Q72: Which of the following expenditures or losses

Q73: Twin City Manufacturing Corporation is an accrual

Q113: Which of the following is/are trade or

Q118: Bonnie's sister, Diane, wants to open a

Q131: All of the following are a required