Essay

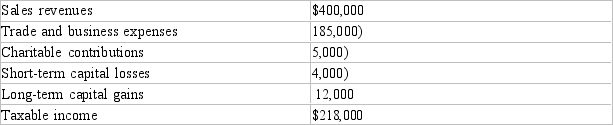

Dustin, Dan, and Dennis operate Heritage Hills dry cleaners as an S corporation. Dustin owns 50% of the business, Dan 30%, and Dennis 20%. For the current year, Heritage Hills reports the following:  How must Heritage Hills report its results to each of the owners?

How must Heritage Hills report its results to each of the owners?

Correct Answer:

Verified

Because capital gains and losses, and ch...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: An ordinary expense<br>I.is normal, common, and accepted

Q31: Oscar drives a taxi on weekends. In

Q34: Which of the following can be deducted

Q47: Generally income tax accounting methods are designed

Q63: Jim operates a business out of his

Q93: To be deductible, the dominant motive for

Q121: During 2014, Myca sells her car for

Q136: Which of the following is/are currently deductible

Q143: Angel owns a gourmet Mexican restaurant. His

Q156: Electronic City sells various electronic products. With