Essay

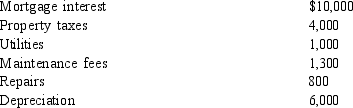

Wilson owns a condominium in Gatlinburg, Tennessee. During the current year, she incurs the following expenses before allocation related to the property:

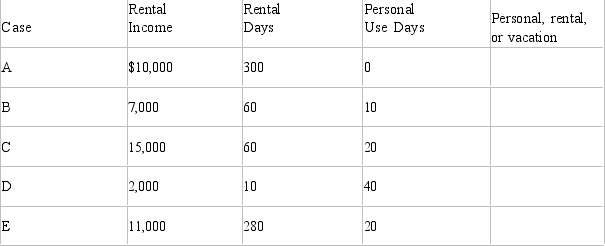

a. For each of the following scenarios indicate whether Wilson would treat the condominium for income tax purposes as personal use property, a rental or a vacation home.

b. Consider Case C. Determine Wilson's deductions related to the condominium. Indicate the

amount of each expense that can be deducted and how it would be deducted.

Correct Answer:

Verified

Wilson can deduct $15,000 in allocated ...

Wilson can deduct $15,000 in allocated ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: A business expense includes<br>I.an expenditure that satisfies

Q9: Which of the following expenses is/are deductible?<br>I.Transportation

Q15: Three requirements must be met in order

Q30: Frank is a self-employed architect who maintains

Q43: Which of the following is/are currently deductible

Q45: Clay incurs $5,000 of investment expenses related

Q62: Harold is a 90% owner of National

Q72: Which of the following is an example

Q115: Which of the following is not deductible?<br>A)Expenses

Q147: Andy lives in New York and rents