Short Answer

Daisy's warehouse is destroyed by a tornado. The warehouse has an adjusted basis of $130,000 when destroyed. Daisy receives an insurance reimbursement check for $150,000 and immediately reinvests $120,000 of the proceeds in a new warehouse. What are Daisy's recognized gain or loss) and her basis in the replacement warehouse?

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Which of the following can be income

Q44: Rationale for nonrecognition includes which of the

Q58: The basis of replacement property in a

Q59: Classification of a nonrecognition transaction as a

Q69: Which of the following qualify as replacement

Q88: Discuss the type of property that is

Q89: A fire destroyed Josh's Scuba Shop. The

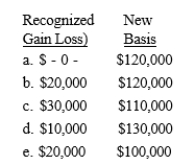

Q90: In each of the following cases, determine

Q94: Which of the following is/are correct regarding

Q107: Roscoe receives real estate appraised at $200,000