Short Answer

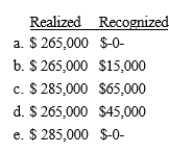

Charlotte purchases a residence for $105,000 on April 13, 2006. On July 1, 2012, she marries Howard and they use Charlotte's house as their principal residence. On May 12, 2014, they sell their home for $390,000, incurring $20,000 of selling expenses and purchase another residence costing $350,000. What is their realized and recognized gain?

Correct Answer:

Verified

Correct Answer:

Verified

Q17: A gain on a like-kind exchange is

Q25: The recognition of a loss realized on

Q31: Rosilyn trades her old business-use car with

Q41: Commonalties of nonrecognition transactions include that<br>I.deferring a

Q49: Lindsey exchanges investment real estate parcels with

Q52: Gain deferral is fundamental to the nonrecognition

Q53: The general mechanism used to defer gains

Q63: Discuss the concepts underlying the determination of

Q76: Norm acquired office equipment for his business

Q99: For related parties to qualify for a