Multiple Choice

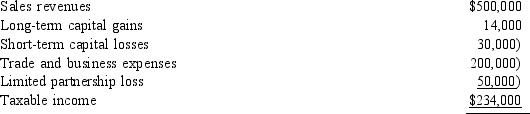

Cornell and Joe are equal partners in Jones Company. For the current year, Jones reports the following items of income and expense:  In addition to his Jones earnings, Joe has other net taxable income of $45,000. Included in the $45,000 is $10,000 in income from a passive activity. Joe's income is:

In addition to his Jones earnings, Joe has other net taxable income of $45,000. Included in the $45,000 is $10,000 in income from a passive activity. Joe's income is:

A) $152,000

B) $157,000

C) $162,000

D) $167,000

E) $182,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A family entity combines the tax-planning aspects

Q3: Bronco Corporation realizes $270,000 from sales during

Q8: Henritta is the sole shareholder of Quaker

Q10: Toliver Corporation incurs a long-term capital loss

Q29: Craig Corporation realizes $150,000 from sales during

Q32: Marian owns 40% of Addison Company, a

Q35: During the current year, Hope Corporation has

Q50: Rinaldo owns 20% of Mahoney Company, a

Q57: Withdrawals of cash by a partner are

Q63: When a corporation pays a dividend, it