Multiple Choice

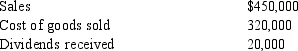

During the current year, Metcalf Corporation has the following items of income and expense:  Metcalf owns 37% of the corporation that distributed the dividend to Metcalf. Determine the amount reported as income before special deductions for the current year.

Metcalf owns 37% of the corporation that distributed the dividend to Metcalf. Determine the amount reported as income before special deductions for the current year.

A) $130,000

B) $134,000

C) $150,000

D) $454,000

E) $470,000

Correct Answer:

Verified

Correct Answer:

Verified

Q6: A corporation may reduce trade or business

Q29: Meritt is a partner in the McPherson

Q40: Valmont owns 98% of the stock of

Q42: During the current year the Newport Partnership

Q65: On a nonliquidating distribution of cash from

Q69: Abaco Corp. has gross income of $230,000

Q75: Corporations that sell depreciable real property are

Q75: Global Corporation distributes property with a basis

Q78: Salem Inc. is an electing S corporation

Q90: Sean Corporation's operating income totals $200,000 for