Short Answer

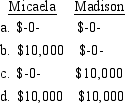

Micaela owns all the shares of the Madison Corporation that operates as an S corporation. Micaela's basis in the stock is $40,000. During the year she receives a cash distribution of $10,000 from Madison. What must Micaela and Madison report as income from the cash distribution?

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Pluto Corporation contributes $30,000 to qualified charitable

Q16: Mariana is a partner in the Benson

Q21: At the beginning of the current year,

Q23: Roy receives a nonliquidating distribution from Ageless

Q40: During the current year,Campbell Corporation receives dividend

Q48: A sole proprietor may deduct investment interest

Q59: Since Wisher, Inc. owns 80% of Patriot,

Q68: During the current year,Timepiece Corporation has operating

Q70: Carlota owns 4% of Express Corporation and

Q72: Virginia is the sole shareholder in Barnes