Short Answer

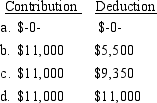

Cisco and Carmen are both in their 30's and are married. Carmen earns $69,000 and Cisco earns $28,000. Their adjusted gross income is $102,000. Carmen is an active participant in her company's pension plan. Cisco's employer does not have a pension plan. What are Carmen and Cisco's maximum combined IRA contribution and deduction amounts?

Correct Answer:

Verified

Correct Answer:

Verified

Q34: Which of the following credits can not

Q40: Jane is a partner with Smithstone LLP.

Q63: The tax advantage of a Roth IRA

Q66: The adjustment for three-fourths of the excess

Q72: Concerning individual retirement accounts (IRAs),<br>I.A single taxpayer

Q76: A taxpayer must begin withdrawals from any

Q77: Posie is an employee of Geiger Technology

Q78: On January 22, 2012, Dalton Corporation granted

Q84: Which of the following is (are) AMT

Q86: In 2014, Billie decides to purchase a