Short Answer

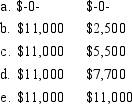

Isabelle and Marshall are married with salaries of $50,000 and $45,000, respectively. Adjusted gross income on their jointly filed tax return is $102,000. Both individuals are active participants in employer provided qualified pension plans. What are Isabelle and Marshall's maximum combined IRA contribution and deduction amounts? Contribution Deduction

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Under a nonqualified pension plan<br>I.The yearly earnings

Q9: Savings incentive match plan for employees (SIMPLE)

Q10: For the current year, Steven's tentative alternative

Q18: When calculating AMTI,individual taxpayers must add back

Q18: A nonqualified stock option is a right

Q20: The maximum contribution that can be made

Q36: Abraham establishes a Roth IRA at age

Q45: Which of the following statements are correct

Q59: Sonya is an employee of Gardner Technology

Q87: IRS scrutiny of reasonable compensation usually deals