Short Answer

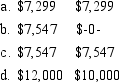

Jim, age 71, is a single taxpayer who retired from his job at the Lansing Corporation in 2013. On January 1, 2014, when he begins to receive his annuity distribution, the value of his pension plan assets is $200,000 and his basis is zero. What amount must Jim receive in 2014 and how much of the amount he receives is taxable? Required Amount Distribution Taxable

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Ross and Reba are both in their

Q7: Roland is an employee with the Belmont

Q16: For the current year, Salvador's regular tax

Q33: To obtain the rehabilitation expenditures tax credit

Q37: Any structure over 100 years old is

Q50: Thelma can get the 10% penalty on

Q88: Arturo is a 15% partner in the

Q92: On January 3, 2014, Great Spirit Inc.,

Q94: On October 2, 2014, Miriam sells 1,000

Q97: On June 1, 2014, Sutton Corporation grants