Essay

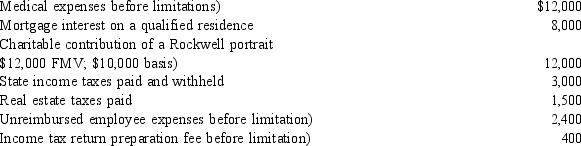

Eileen is a single individual with no dependents. Her adjusted gross income for 2014 is $60,000. She has the following items that qualify as itemized deductions. What is the amount of Eileen's AMT adjustment for itemized deductions for 2014?

Correct Answer:

Verified

Eileen must add back $6,100 of...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Harriet is an employee of Castiron Inc.

Q9: Jose is an employee of O'Hara Industry

Q9: Savings incentive match plan for employees (SIMPLE)

Q10: For the current year, Steven's tentative alternative

Q18: When calculating AMTI,individual taxpayers must add back

Q30: Ken is a 15% partner in the

Q59: A U.S.formed multinational corporation<br>I.Can avoid the payment

Q59: Sonya is an employee of Gardner Technology

Q66: Which of the following itemized deductions is

Q70: Coffin Corporation (a domestic corporation)has $200,000 of