Short Answer

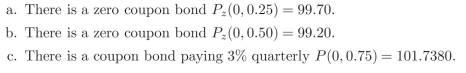

What is the price of a 0.75-year ?oating rate bond that pays a semiannual coupon equal to ?oating rate plus 2% spread? We know the following:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: A Treasury dealer quotes the following 182-day

Q2: For the following scenario, check if there

Q4: For the following scenario, check if there

Q5: Using the previous discount curve price the

Q6: For the following scenario, check if there

Q7: From the following data obtain the discount

Q8: Using the previous discount curve price the

Q9: A Treasury dealer quotes the following 91-day

Q10: For the following scenario, check if there

Q11: What is the price on a 5.75-year