Essay

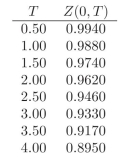

You are given the following discount factors:  You are told that the price of a European Call option on a 6-month zero coupon bond, with T =0.5andK =99.35 is 0.13. While the price of a European Put option with the exact same specification is: 0.11. Are the securities adequately priced?

You are told that the price of a European Call option on a 6-month zero coupon bond, with T =0.5andK =99.35 is 0.13. While the price of a European Put option with the exact same specification is: 0.11. Are the securities adequately priced?

Correct Answer:

Verified

No, according to Put...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: What does mark-to-market mean?

Q6: What is to tail the hedge?

Q7: Under what conditions are futures and forwards

Q8: What is an American Put option?

Q9: What are the shortcomings of futures, when

Q10: What will be the value of a

Q11: What are the advantages of futures contracts,

Q12: What is a European Call option?

Q14: What are the main di?erences between a

Q15: What is the difference between a European