Essay

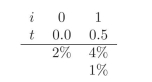

You are given the following interest rate tree. Use it when required in the

exercises.

-What is a replicating portfolio?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: You are given the following interest rate

Q6: What is a risk neutral probability?

Q7: What values can a one year zero

Q8: What is the risk neutral probability p∗

Q9: Why are forward interst rates and the

Q10: Using risk neutral pricing obtain the value

Q11: Are forward interest rates equal to the

Q12: from a given risk neutral tree

Q14: Given the tree at the begining of

Q15: What is the market price of risk?