Essay

Racer Industries is currently purchasing Part No. 76 from an outside supplier for $80 per unit. Because of supplier reliability problems, the company is considering producing the part internally in an idle manufacturing plant. Annual volume over the next six years is expected to total 300,000 units at variable manufacturing costs of $75 per unit.

Racer must acquire $80,000 of new equipment if it reopens the plant. The equipment has a six-year service life, a $14,000 salvage value, and will be depreciated by the straight-line method. Repairs and maintenance are expected to average $5,200 per year in years 4-6, and the equipment will be sold at the end of its life.

Required:

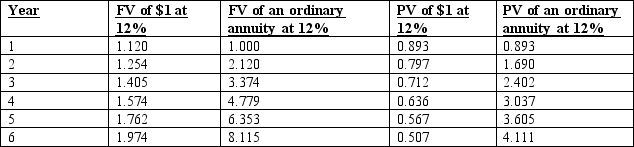

Rounding to the nearest dollar, use the net-present-value method (total-cost approach) and a 12% hurdle rate to determine whether Mark should make or buy Part No. 76. Ignore income taxes.

Correct Answer:

Verified

Correct Answer:

Verified

Q93: The Modified Accelerated Cost Recovery System (MACRS)

Q94: Postaudits are an important part of capital

Q95: A machine costs $25,000; it is expected

Q96: The internal rate of return:<br>A) ignores the

Q97: A machine is expected to produce annual

Q99: The hurdle rate that is used in

Q100: The mayor of Trenton is considering the

Q101: Upton evaluates future projects by using the

Q102: Barton Company can acquire a $900,000 machine

Q103: A company that is using the internal