Multiple Choice

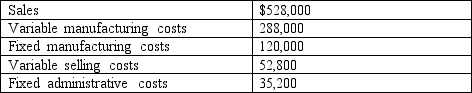

Brilliant, Inc. reported the following results from the sale of 24,000 units of IT-54:

Extra Company has offered to purchase 3,000 IT-54s at $16 each. Brilliant has available capacity, and the president is in favor of accepting the order. She feels it would be profitable because no variable selling costs will be incurred. The plant manager is opposed because the "full cost" of production is $17. Which of the following correctly notes the change in income if the special order is accepted?

A) $3,000 decrease.

B) $3,000 increase.

C) $12,000 decrease.

D) $12,000 increase.

E) None of the answers is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q29: Two months ago, Air-tite Corporation purchased 4,500

Q30: The cost of inventory currently owned by

Q31: Kranston Company is considering whether to sell

Q32: Townson Company manufactures G and H in

Q33: Tyson Corner Manufacturing produces two bearings: C15

Q35: The term "opportunity cost" is best defined

Q36: Use this information to answer the following

Q37: In most all decisions, joint costs are

Q38: Homer Enterprises, which produces various goods, has

Q39: To be useful in decision making, information