Multiple Choice

Use the following information to answer the following Questions

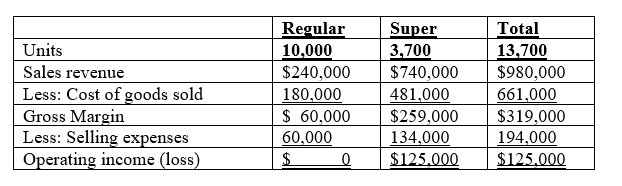

Omar Industries manufactures two products: Regular and Super. The results of operations for 20x1 follow.

Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed.

-Omar Industries wants to drop the Regular product line. If the line is dropped, company-wide fixed manufacturing costs would fall by 10% because there is no alternative use of the facilities. What would be the impact on operating income if Regular is discontinued?

A) $0.

B) $10,400 increase.

C) $20,000 increase.

D) $39,600 decrease.

E) None of the answers is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q59: Use the following information to answer the

Q60: Cost predictions relevant to repetitive decisions typically

Q61: Allison is contemplating a job offer with

Q62: Factors in a decision problem that cannot

Q63: Carlton Corporation is composed of five divisions.

Q65: A special order generally should be accepted

Q66: Icon, Inc. produces a variety of products

Q67: McAlister Company is operating at capacity and

Q68: Which of the following statements regarding costs

Q69: The following costs are relevant to the