Essay

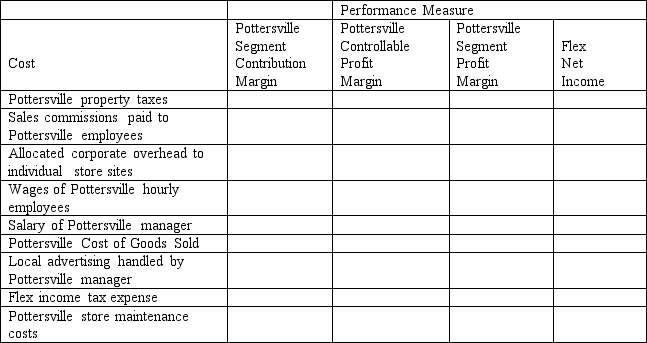

Flex, Inc., which is headquartered in Hoboken, New Jersey, operates a chain of 125 shoe stores throughout the United States. Consider the costs that appear in the following table, many of which pertain to the company's sole operation in Pottersville, New Jersey:

Specify store maintenance as a fixed costs. Adopt the following language. "Pottersville store maintenance costs as agreed upon in yearly maintenance contract negotiated by Pottersville manager."

Required:

Analyze each of the costs and determine whether the cost affects Pottersville segment contribution margin, controllable profit margin, and segment profit margin, and/or the net income of Flex, Inc. Place an "X" in the appropriate cell(s).

Correct Answer:

Verified

Correct Answer:

Verified

Q39: A company-owned restaurant in a fast-food chain

Q40: Use the following information to answer the

Q41: Which of the following measures would reflect

Q42: Common costs are charged to a company's

Q43: Which of the following balanced-scorecard perspectives is

Q45: A company's balanced scorecard should focus on

Q46: For a company that uses responsibility accounting,

Q47: Pride Company is preparing a segmented income

Q48: Gator Country Cable, Inc. is organized in

Q49: Use the following information to answer the