Short Answer

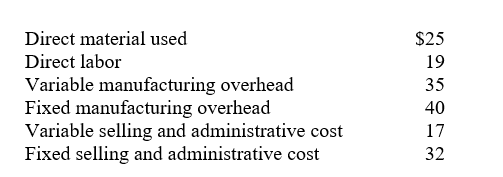

Falisari Corporation has computed the following unit costs for the year just ended:

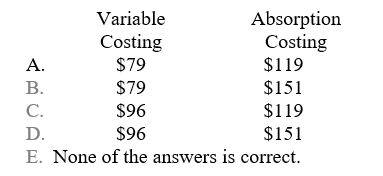

Which of the following choices correctly depicts the per-unit cost of inventory under variable costing and absorption costing?

Correct Answer:

Verified

Correct Answer:

Verified

Q64: Absorption costing is inconsistent with CVP analysis.

Q65: Use the following information to answer the

Q66: Dalton Corporation has fixed manufacturing cost of

Q67: List and define four types of product

Q68: Carolina Corporation, which uses throughput costing, began

Q69: The table that follows denotes selected characteristics

Q70: Hid?den private environmental costs are those that

Q71: Which of the following statements pertain to

Q73: The following data relate to Jupiter Company,

Q74: Vero, Inc. began operations at the start