Essay

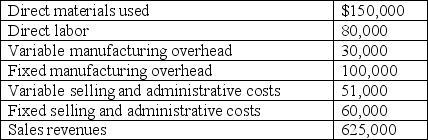

Information taken from Horner Corporation's May accounting records follows.

Required:

A. Assuming the use of variable costing, compute the inventoriable costs for the month.

B. Compute the month's inventoriable costs by using absorption costing.

C. Assume that anticipated and actual production totaled 20,000 units, and that 18,000 units were sold during May. Determine the amount of fixed manufacturing overhead and fixed selling and administrative costs that would be expensed for the month under (1) variable costing and (2) absorption costing.

D. Assume the same data as in requirement "C." Compute the contribution margin that would be reported on a variable-costing income statement.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: For external-reporting purposes, generally accepted accounting principles

Q25: The underlying difference between absorption costing and

Q26: Which of the following formulas can often

Q27: All of the following costs are inventoried

Q28: The optimum level of product quality is

Q30: Craig Company has per-unit fixed and variable

Q31: Montana Industries has computed the following unit

Q32: Use the following information to answer the

Q33: Chu Enterprise's inventory increased during the year.

Q34: The difference in income between absorption and