Essay

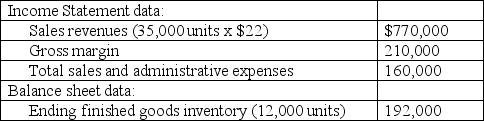

Carrington, Inc. began business at the start of the current year and maintains its accounting records on an absorption-cost basis. The following selected information appeared on the company's income statement and end-of-year balance sheet:

Carrington achieved its planned production level for the year. The company's fixed manufacturing overhead totaled $141,000, and the firm paid a 10% commission based on gross sales dollars to its sales force.

Required:

A. How many units did Carrington plan to produce during the year?

B. How much fixed manufacturing overhead did the company apply to each unit produced?

C. Compute Carrington's cost of goods sold.

D. How much variable cost did the company attach to each unit manufactured?

Correct Answer:

Verified

A. Sales (35,000 units) + ending finishe...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q52: Use the following information to answer the

Q53: Cost-volume-profit analysis and break-even calculations account for

Q54: When discussing the costs of quality, the

Q55: Absorption and variable costing are two different

Q56: Variable costing of inventory and absorption costing

Q58: Razor Technologies reported $106,000 of income for

Q59: Variable manufacturing overhead becomes part of a

Q60: When units sold exceed units produced, absorption-costing

Q61: Absorption costing is required for tax purposes.

Q62: ProTech began business at the start of