Essay

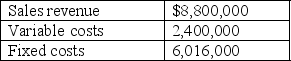

The information that follows was obtained from the accounting records of Portofino Manufacturing during a period when the company sold 100,000 units.

Required:

A. Compute the company's per-unit contribution margin and break-even point in units.

B. How many units must Portofino sell to produce a target profit of $550,400?

C. Assume that Portofino was able to reduce the variable cost per unit by $4. What selling price could management charge if it desired to maintain the current break-even point?

D. Depreciation charges of $640,000 are included in the firm's fixed costs of $6,016,000. If these charges were to increase by 10%, what effect, if any, would this cost increase have on the company's contribution margin?

Correct Answer:

Verified

Correct Answer:

Verified

Q30: Sensitivity analysis has become relatively easy to

Q31: A company that desires to lower its

Q32: Randy's Pizza delivers pizzas to dormitories and

Q33: The assumptions on which cost-volume-profit analysis is

Q34: At a volume of 20,000 units, Almount

Q36: The difference between budgeted sales revenue and

Q37: Which of the following underlying assumptions form(s)

Q38: The contribution-margin ratio is calculated as unit

Q39: Use the following information to answer the

Q40: Finn's budget for the upcoming year revealed