Essay

Fairchild, Inc., manufactures two products, Regular and Deluxe, and applies overhead on the basis of direct labor hours. Anticipated overhead and direct labor time for the upcoming accounting period are $1,600,000 and 25,000 hours, respectively. Information about the company's products follows.

Regular-

Estimated production volume: 3,000 units

Direct materials cost: $28 per unit

Direct labor per unit: 3 hours at $15 per hour

Deluxe-

Estimated production volume: 4,000 units

Direct materials cost: $42 per unit

Direct labor per unit: 4 hours at $15 per hour

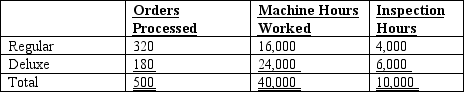

Fairchild's overhead of $1,600,000 can be identified with three major activities: order processing ($250,000), machine processing ($1,200,000), and product inspection ($150,000). These activities are driven by number of orders processed, machine hours worked, and inspection hours, respectively. Data relevant to these activities follow.

Required:

A. Compute the pool rates that would be used for order processing, machine processing, and product inspection in an activity-based costing system.

B. Assuming use of activity-based costing, compute the unit manufacturing costs of Regular and Deluxe if the expected manufacturing volume is attained.

C. How much overhead would be applied to a unit of Regular and Deluxe if the company used traditional costing and applied overhead solely on the basis of direct labor hours? Which of the two products would be undercosted by this procedure? Overcosted?

Correct Answer:

Verified

A. Order processing: $250,000/ 500 order...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Anton's Fresh Fish and Produce is a

Q14: Trayton Enterprises, which manufactures lawn mowers, recently

Q15: In an activity-based costing system, direct materials

Q16: Traditional product-costing systems are structured on multiple,

Q17: Consumption ratios are useful in determining the

Q19: One of the important factors when selecting

Q20: Customer-profitability analysis uses activity-based costing to determine

Q21: Flagler Corporation takes eight hours to complete

Q22: Use the following information to answer the

Q23: Flavorful Manufacturing sells a number of goods