Multiple Choice

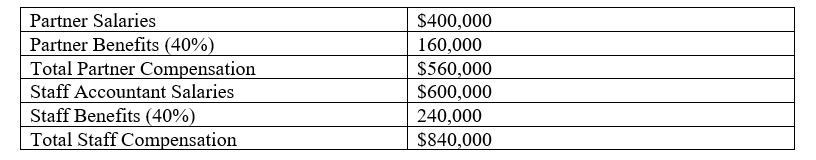

Use the following labor budget data for Roy & Miller Accounting, LLP to answer the following Questions The budgeted overhead cost for the year is $1,260,000. The company has estimated that one-third of the budgeted over¬head cost is incurred to support the firm’s two partners, and two-thirds goes to support the staff accountants. The current audit bid for Monoco Industries requires $18,000 in direct partner professional labor, $30,000 in direct staff accountant professional labor, $5,000 in direct material,

The budgeted overhead cost for the year is $1,260,000. The company has estimated that one-third of the budgeted over¬head cost is incurred to support the firm’s two partners, and two-thirds goes to support the staff accountants. The current audit bid for Monoco Industries requires $18,000 in direct partner professional labor, $30,000 in direct staff accountant professional labor, $5,000 in direct material,

-What is the overhead rate for partners, if separate rates are used for partners and staff accountants?

A) 90%

B) 75%

C) 60%

D) 225%

E) 50%

Correct Answer:

Verified

Correct Answer:

Verified

Q73: Templeton Corporation recently used $75,000 of direct

Q74: Manufacturing overhead is applied to production.<br>A. Describe

Q75: Which of the following would not likely

Q76: Osgood Company, which applies overhead at the

Q77: A review of a company's Work-in-Process Inventory

Q79: Electricity costs that were incurred by a

Q80: In traditional product-costing systems, the measure of

Q81: If the amount of effort and attention

Q82: Two-stage cost allocation uses a first stage

Q83: Boxer Industries worked on four jobs during