Multiple Choice

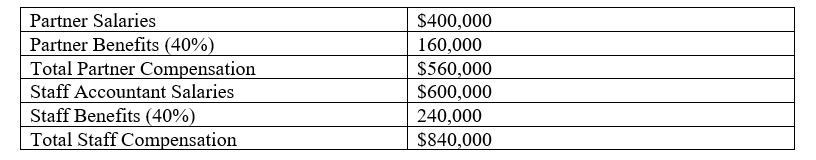

Use the following labor budget data for Roy & Miller Accounting, LLP to answer the following Questions The budgeted overhead cost for the year is $1,260,000. The company has estimated that one-third of the budgeted over¬head cost is incurred to support the firm’s two partners, and two-thirds goes to support the staff accountants. The current audit bid for Monoco Industries requires $18,000 in direct partner professional labor, $30,000 in direct staff accountant professional labor, $5,000 in direct material,

The budgeted overhead cost for the year is $1,260,000. The company has estimated that one-third of the budgeted over¬head cost is incurred to support the firm’s two partners, and two-thirds goes to support the staff accountants. The current audit bid for Monoco Industries requires $18,000 in direct partner professional labor, $30,000 in direct staff accountant professional labor, $5,000 in direct material,

-What is the overhead rate for staff accountants, if separate rates are used for partners and staff accountants?

A) 50%

B) 75%

C) 66.7%

D) 100%

E) 150%

Correct Answer:

Verified

Correct Answer:

Verified

Q43: The process of assigning overhead costs to

Q44: Manufacturing overhead is a pool of indirect

Q45: Under- or overapplied manufacturing overhead at year-end

Q46: Farmington and Associates designs relatively small sports

Q47: Terrence Industries charges manufacturing overhead to products

Q49: A predetermined overhead rate is calculated by

Q50: In a public accounting firm, for example,

Q51: When selecting a volume-based cost driver, the

Q52: Blakely charges manufacturing overhead to products by

Q53: Altman Corporation uses a job-cost system and