Essay

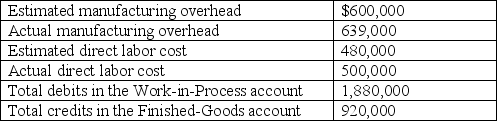

Bartlett Corporation, which began operations on January 1 of the current year, reported the following information:

Bartlett uses a normal cost system and applies manufacturing overhead to jobs on the basis of direct labor cost. A 60% markup is added to the cost of completed production when finished goods are sold. On December 31, job no. 18 was the only job that remained in production. That job had direct-material and direct-labor charges of $16,500 and $36,000, respectively.

Required:

A. Determine the company's predetermined overhead rate.

B. Determine the amount of under- or overapplied overhead. Be sure to label your answer.

C. Compute the amount of direct materials used in production.

D. Calculate the balance the company would report as ending work-in-process inventory.

E. Prepare the journal entry (ies) needed to record Bartlett's sales, which are all made on account.

Correct Answer:

Verified

A. Predetermined overhead rate: $600,000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Use the following labor budget data for

Q22: When underapplied or overapplied manufacturing overhead is

Q23: Which of the following statements is true?<br>A)

Q24: Under- or overapplied manufacturing overhead at year-end

Q25: Throughout the accounting period, the credit side

Q27: Which of the following entities would not

Q28: Caldon Products started and finished job no.

Q29: Pincus Corporation, which uses a job-costing system,

Q30: Norwood Corporation uses a predetermined overhead rate

Q31: Use the following labor budget data for