Essay

Bonanza Enterprises provides consulting services and uses a job-order system to accumulate the cost of client projects. Traceable costs are charged directly to individual clients; in contrast, other costs incurred by Bonanza , but not identifiable with specific clients, are charged to jobs by using a predetermined overhead application rate. Clients are billed for directly chargeable costs, overhead, and a markup.

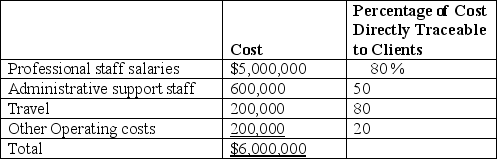

Bonanza anticipates the following costs for the upcoming year:

Bonanza's partners desire to make a $480,000 profit for the firm and plan to add a percentage markup on total cost to achieve that figure.

On May 14, Bonanza completed work on a project for Laramie Manufacturing. The following costs were incurred: professional staff salaries, $68,000; administrative support staff, $8,900; travel, $10,500; and other operating costs, $2,600.

Required:

A. Determine Bonanza's total traceable costs for the upcoming year and the firm's total anticipated overhead.

B. Calculate the predetermined overhead rate. The rate is based on total costs traceable to client jobs.

C. What percentage of total cost will Bonanza add to each job to achieve its profit target?

D. Determine the total cost of the Laramie Manufacturing project. How much would Laramie be billed for services performed?

Correct Answer:

Verified

A. Traceable costs total $4,500,000, com...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q60: Mountain Man Corporation debited Cost of Goods

Q61: In the two-stage cost allocation process, costs

Q62: Job-order costing methods are used in a

Q63: As production takes place, all manufacturing costs

Q64: The primary difference between normalized and actual

Q66: Discuss the reason for (1) allocating overhead

Q67: The estimates used to calculate the predetermined

Q68: The left side of the Manufacturing Overhead

Q69: Which of the following statements about manufacturing

Q70: Which of the following is not considered