Essay

Dodge City Corporation is developing departmental overhead rates based on direct labor hours for its two production departments, Molding and Assembly. The Molding Department worked 20,000 hours during the period just ended, and the Assembly Department worked 40,000 hours. The overhead costs incurred by Molding and Assembly were $151,250 and $440,750, respectively.

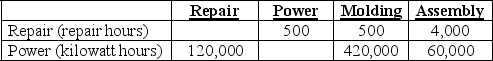

Two service departments, Repair and Power, directly support the two production departments. These service departments have costs of $90,000 and $250,000, respectively. The following schedule reflects the use of Repair and Power's output by the various departments:

Required:

A. Allocate the company's service department costs to production departments by using the direct method.

B. Calculate the overhead application rates of the production departments. Hint: Consider both directly traceable and allocated overhead when deriving your answer.

C. Allocate the company's service department costs to production departments by using the step-down method. Begin with the Power Department, and round calculations to the nearest dollar.

Correct Answer:

Verified

Correct Answer:

Verified

Q40: Which of the following would not be

Q41: Consider the following statements about dual-cost allocation:<br>I.

Q42: Use this information to answer the following

Q43: The net-realizable-value method is the least preferred

Q44: Oxmoor Corporation has two service departments (Maintenance

Q46: The point in a joint production process

Q47: In the net-realizable-value method, the joint cost

Q48: Sparkle Metallurgy, Inc. has two service departments

Q49: Use the following information to answer the

Q50: Which of the following methods ignores the