Multiple Choice

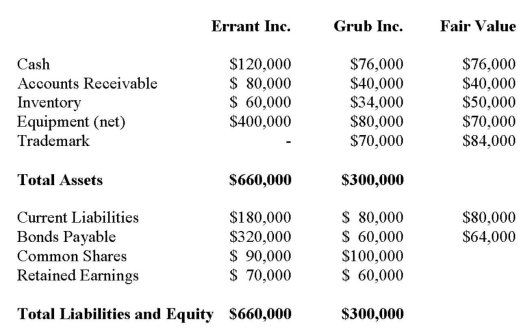

Errant Inc. purchased 100% of the outstanding voting shares of Grub Inc. for $200,000 on January 1, 2012. On that date, Grub Inc. had common stock and retained earnings worth $100,000 and $60,000, respectively. Goodwill is tested annually for impairment. The Balance Sheets of both companies, as well as Grub's fair market values on the date of acquisition are disclosed below:  The net incomes for Errant and Grub for the year ended December 31, 2012 were $160,000 and $90,000 respectively. Grub paid $9,000 in Dividends to Errant during the year. There were no other inter-company transactions during the year. Moreover, an impairment test conducted on December 31, 2012 revealed that the Goodwill should actually have a value of $20,000. Both companies use a FIFO system, and most of Grub's inventory on the date of acquisition was sold during the year. Errant did not declare any dividends during the year. Assume that Errant Inc. uses the Equity Method unless stated otherwise. How much Goodwill will be carried on Grub's Balance Sheet on December 31, 2012?

The net incomes for Errant and Grub for the year ended December 31, 2012 were $160,000 and $90,000 respectively. Grub paid $9,000 in Dividends to Errant during the year. There were no other inter-company transactions during the year. Moreover, an impairment test conducted on December 31, 2012 revealed that the Goodwill should actually have a value of $20,000. Both companies use a FIFO system, and most of Grub's inventory on the date of acquisition was sold during the year. Errant did not declare any dividends during the year. Assume that Errant Inc. uses the Equity Method unless stated otherwise. How much Goodwill will be carried on Grub's Balance Sheet on December 31, 2012?

A) Nil.

B) ($24,000) .

C) $20,000.

D) $24,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: GNR Inc. owns 100% of NMX Inc.

Q18: Intangible assets with definite useful lives should

Q21: Prior to July 2001, the required treatment

Q22: A Company sells inventory to its Subsidiary,

Q23: Any excess of fair value over book

Q23: Errant Inc. purchased 100% of the outstanding

Q24: Consolidated Net Income is equal to:<br>A) the

Q24: Errant Inc. purchased 100% of the outstanding

Q25: Consolidated Retained Earnings include:<br>A) consolidated net income

Q25: Big Guy Inc. purchased 80% of the