Short Answer

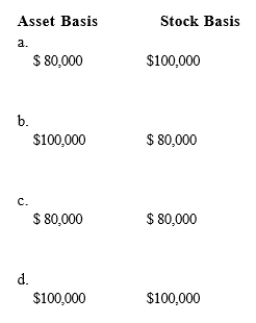

Ruchi contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity.If the entity is a partnership and the transaction qualifies under § 721, the partnership's basis for the property and the partner's basis for the partnership interest are:

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A limited partnership can indirectly avoid unlimited

Q9: Match the following statements.<br>-Sale of the corporate

Q16: Molly transfers land with an adjusted basis

Q44: Melanie and Sonny form Bird Enterprises. Sonny

Q45: S corporation status always avoids double taxation.

Q60: Match the following statements.<br>-S corporations<br>A)Usually subject to

Q80: Match the following attributes with the different

Q83: Of the corporate types of entities, all

Q85: If lease rental payments to a noncorporate

Q92: All of the shareholders of an S