Short Answer

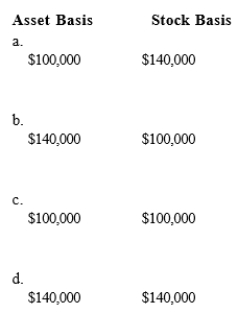

Martin contributes property with an adjusted basis of $100,000 and a fair market value of $140,000 to a newly formed business entity.If the entity is an S corporation and the transaction qualifies under § 351, the S corporation's basis for the property and the shareholder's basis for the stock are:

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A limited partnership can indirectly avoid unlimited

Q16: Molly transfers land with an adjusted basis

Q29: Alice contributes equipment fair market value of

Q30: Techniques that may permit a C corporation

Q47: Both Tracy and Cabel own one-half of

Q59: Jane is going to invest $90,000 in

Q64: Catfish, Inc., a closely held corporation that

Q83: Of the corporate types of entities, all

Q103: A corporation has a greater potential for

Q107: The special allocation opportunities that are available