Multiple Choice

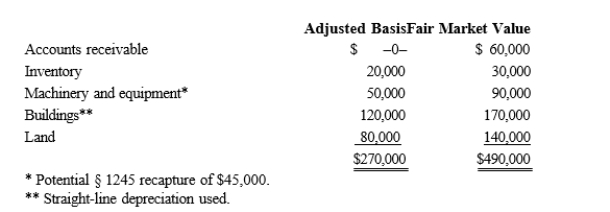

Albert's sole proprietorship owns the following assets.  Albert sells his sole proprietorship for $500,000.Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

Albert sells his sole proprietorship for $500,000.Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Mercedes owns a 30% interest in Magenta

Q22: Candace, who is in the 32% tax

Q31: Transferring funds that are deductible by the

Q39: John wants to buy a business whose

Q62: The AMT statutory rate for S corporation

Q66: If an S corporation distributes appreciated property

Q74: Tuan and Ella are going to establish

Q88: Match the following statements.<br>-Net capital gain<br>A)For the

Q91: Wally contributes land adjusted basis of $30,000;

Q96: Match the following statements.<br>-C corporations<br>A)Usually subject to